Equity Crowdfunding 101: Become a Shareholder in Waverly Labs

Waverly Labs is currently raising up to $10M+ via a Regulation Crowdfunding (Reg A) offering on StartEngine. We want to enable our customers and stakeholders who believe in us the most the opportunity to invest in and become a part of our growth as we continue to get closer to solving the language barriers in global business and commerce world-wide.

Investments in Waverly Labs can be purchased starting at $496, with various investor perks being unlocked at higher levels of investment. To learn more about our perks and invest in our campaign, you can visit our StartEngine campaign page here.

In this blog, we will outline what raising capital via Regulation Crowdfunding means, why we chose to go this route with our raise, and the step-by-step process on how YOU can now be part of Waverly’s investor community.

What You Need to Know About Equity Crowdfunding

Equity crowdfunding is a process whereby people (the crowd) can invest in early stage companies that are yet to be listed on public exchanges for shares. As a shareholder, you are a part owner of the company and stand to benefit if the company does well. You can think of equity crowdfunding as being something like Kickstarter meets Shark Tank!

Previously, investing in startups was a privilege available to only a select few: angel investors, venture capitalists (VCs), and ultra-high net worth individuals. However, now the tide is finally turning. Thanks to the SEC enacting Title III of the JOBS Act in 2016, Regulation Crowdfunding (Reg CF and Reg A) has become a growing force in the United States. Regulation crowdfunding gives everyday people the opportunity to invest in private companies alongside accredited investors for the first time in history, as long as they make their investments through SEC-registered, FINRA-regulated intermediary funding portals like StartEngine.

The JOBS Act of 2012 increased the shareholder threshold for companies that choose to remain privately-held from 500 to 2,000 shareholders. Additionally, a special feature of regulation crowdfunding allows privately-held companies to go beyond 2,000 shareholders as long as the company is using an SEC-registered transfer agent. The bill eased restrictions on the buying and selling of securities, enabling startup companies like Waverly Labs to fundraise up to a certain amount annually through crowdfunding portals registered with the Securities and Exchange Commission (SEC).

Reg A has ushered in the democratization of private capital markets. Non-accredited investors, meaning individual retail investors (AKA, the general public) earning less than $200,000 or have a net worth less than $1M outside their primary residence, can annually invest up to either $2,000 or 5% of their annual income or net worth, whichever is greater.

Reg A doesn’t only stand to benefit the public—it benefits companies like Waverly Labs too. In the past, startups had no choice but to raise capital through VC firms and other corporate avenues. Now, in addition to going the VC route, Waverly Labs can raise money directly through all of our fans and loyal supporters, a global community of tens of thousands of people. We want our investors to be our biggest brand ambassadors and vice versa!

Brand new rules changes to Reg A and Reg CF campaigns now make this an especially attractive avenue to Waverly Labs to raise funds:

Reg A

- Companies can select a tier 1 or a tier 2 campaign

- Higher Funding Limits: Increased from $50M to $75M

- Can run “Test The Waters” campaign prior to public launch

- Both non-accredited investors and accredited investors can participate

- Can be conducted through a portal or on company’s website

- Must file with the SEC with an audited financial statement

Reg CF

- Higher Funding Limits: Increased from $1.07M to $5M

- Can run “Test The Waters” campaign prior to public launch

- Both non-accredited investors and accredited Investors can participate

- MUST be conducted through an SEC-regulated funding platform like StartEngine

- Company must file an Offering Memorandum “Form C” with the SEC

- Audited financial states required for most companies

Waverly Lab’s Reg A Goals

We have several ambitious goals in mind for our Ambassador Interpreter that we can reach with the support of a successful equity crowdfunding campaign. With our funding we plan to:

- Launch our Android-only model

- Launch a “Pro” version subscription model

- Launch our e-commerce and retail platforms

How to Invest in Waverly Labs

Step 1: Hit the “Invest Now” button.

Step 2: Enter your investment amount.

Step 3: Minimum investment amount to invest in Waverly Labs is $496.16 but you can invest any amount of your choosing.

Step 4: The portal requires your annual income and net worth to determine your investment limits for Regulation Crowdfunding.

Step 5: You will need to add:

- Definition of net worth

- How it can be calculated

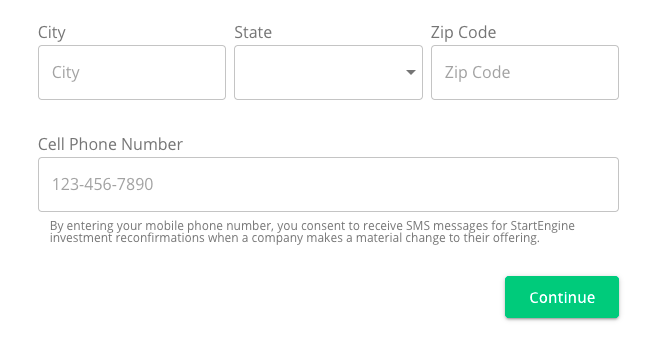

Step 6: Enter your contact information.

Step 7: No international investments will be allowed at this time unfortunately.

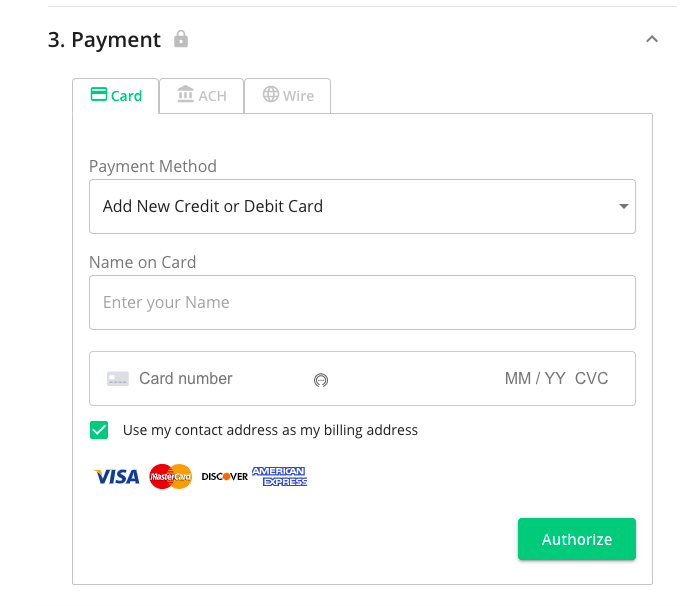

Step 8: Next step is payment, 3 payment methods are accepted:

- CC

- Wire (minimum investment amount required for wire is $750)

- ACH

Step 9: Fill out the personal information section—these fields are self-explanatory.

Step 10: Next step is Investor Profile. This information is needed just for SE to understand your investment preferences and experience a little better. All the fields are drop-down so just select the one that’s most relevant for you.

Step 11: Next step is Verification. SE will need your SSN or Tax ID for this part.

Step 12: Review the terms and conditions and then sign in the field below by typing your name out in full. Hit the next button.

Step 13: Review these important agreements (StartEngine Agreement) and Custodial Agreement before the final sign-off.

Congratulations! Once you sign by typing out your full name and hit the complete investment button, your investment will have officially been submitted!

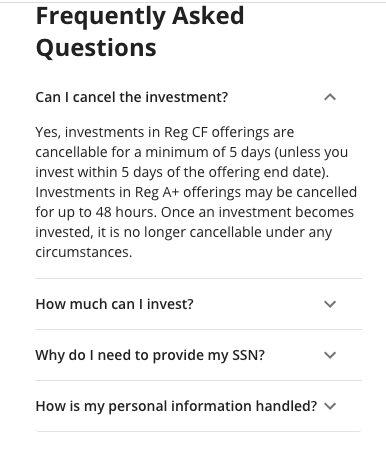

Below are a few Investor FAQs to help you get through this process with trust and confidence:

Last but not the least, you can use your investor dashboard on StartEngine, where you will be able to monitor and track the status of your investment with Waverly Labs.

Don’t Miss The Opportunity to Invest in Waverly Labs!

If you want to invest in a company that has an exciting future and will make a difference in our ability to communicate with humanity, then join Waverly Labs’s equity crowdfunding campaign. Your investment will make you an owner of our company so you can make a difference while also benefiting from our success.

We encourage you to invest in Waverly Labs today and join our mission as an investor! If you have questions, please leave them in the Comments section of our campaign page and our team will be sure to address them as soon as possible.

This Reg. A+ offering is made available through StartEngine Primary, LLC, member FINRA/SIPC.

This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information about this offering, please view Waverly Labs offering circular as well as the risks associated with this offering.